RESIDENCY PERMIT ANDORRA

There are two different possibilities for residency in Andorra.

1 PASSIVE RESIDENCE

Residence permit without work permit

It is valid for 1 year , then twice for 3 years and end extends one by 10 years .

2 ACTIVE RESIDENCE

Residence permit work permit.

It has its own rules and is much more restrictive than the passive implementation. If you are interested in the active implementation contact us.

Conditions necessary to formalize the application for residence Pasiva

- To be over 18 years old.

- Show that you do not have a criminal record.

- Physically reside in Andorra a minimum of 90 days per calendar year.

- Leave some 50,000 euros as a deposit, plus about 10,000 euros per family member in charge of the main person. The amount of this finaza, you have to pay the INAF (National Institute of Finance), which will be returned after your stay in the Principality of Andorra.

- Undergo a medical examination during the time after the application of passive residence month.

- Demonstrate that you have the necessary resources to meet their needs.

- I justify invalidity old age is covered socially, through an insurance covering illness.

Documents required for application

- Extract from criminal record.

- Passport and certificate of marital status.

- Photocopy of proof of deposit of 50,000 euros in the INAF (National Institute of Finance), plus 10,000 euros per person in charge.

- Originals of the contracts to buy or rent a home.

- Documents proving disability insurance, illness and retirement. For people insured by the French Social Security, in the general scheme or the special agrarian regime.

- Medical certificate issued by a physician of the Principality of Andorra.

- Test, using a title or bank guarantees, of 300% income above the minimum wage of Andorra, which is 951.60 euros, plus 100% for each additional member in charge.

- Signing a document that commits to live in Andorra a minimum of 90 days per year.

- Certain applicants are required to invest € 400,000 in Andorra as part of the application process. This investment can be done either estate properties, as a bank deposit, as an investment in an Andorran company, or as an interest-bearing deposit with the INAF (National Financial Institute). This investment is only required for applicants who have retired, ie no longer actively working. Applicants assets in international business, sports, arts or research and development are not obliged to make this investment, which has been granted residence.

LIVING IN ANDORRA

Andorra is the perfect home base for those who want to have a minimum tax burdens while increasing your quality of life , with leisure and relaxation.

Andorra has an attractive tax system and unique, for people who want to live in the Principality. There is also no restrictions on the movement of capital and real estate assets. You can enjoy the assets you have.

The corporate tax is minimal, because the companies only pay an annual taxa trade to the municipality, which for most businesses amounts to less than 2,000 euros per year. Another important and to consider attribute is the strict banking secrecy, unless there injunction.

If one gets residency in Andorra, you are not required to have all of its assets in Andorra.

Weather in Andorra is very nice . More than 300 days of sunshine and moderate all year, low humidity and the total absence of industry temperatures are some factors that give Andorra life expectancy world's highest 83.5 years.

The Mediterranean Sea is only about two hours away.

We must not forget that Andorra crime is very low . There is a wide variety of nationalities found in Andorra their place of main residence. Andorra is particularly popular with the Spanish, French, English, Dutch and Scandinavians.

Andorra offers sports and entertainment for the whole family - in summer and winter- and has invested in recent years in improving the country's infrastructure and the extension of ski areas.

Unlike other places that skiing - all the hotels and shops stay open all year, except on March 14, on September 8, December 25 and January 1, which only stores are closed .

Andorra has an attractive tax system and unique, for people who want to live in the Principality. There is also no restrictions on the movement of capital and real estate assets. You can enjoy the assets you have.

The corporate tax is minimal, because the companies only pay an annual taxa trade to the municipality, which for most businesses amounts to less than 2,000 euros per year. Another important and to consider attribute is the strict banking secrecy, unless there injunction.

If one gets residency in Andorra, you are not required to have all of its assets in Andorra.

Weather in Andorra is very nice . More than 300 days of sunshine and moderate all year, low humidity and the total absence of industry temperatures are some factors that give Andorra life expectancy world's highest 83.5 years.

The Mediterranean Sea is only about two hours away.

We must not forget that Andorra crime is very low . There is a wide variety of nationalities found in Andorra their place of main residence. Andorra is particularly popular with the Spanish, French, English, Dutch and Scandinavians.

Andorra offers sports and entertainment for the whole family - in summer and winter- and has invested in recent years in improving the country's infrastructure and the extension of ski areas.

Unlike other places that skiing - all the hotels and shops stay open all year, except on March 14, on September 8, December 25 and January 1, which only stores are closed .

Immoac.com it is available at any time to advise me with the formalities of residence, finding a property purchase or rent.

- Andorra is one of the countries with highest per capita income in Europe , and also has a low cost of living

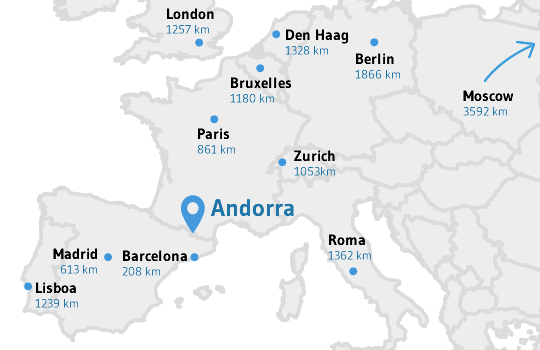

- Strategic location in the center of Europe with access to 500 potential million customers

- Andorra has coverage fiber optic 100% of its territory

- Andorra has one of the lowest in Europe with a maximum corporation tax of 10% fiscal pressures

- Andorra labor costs are very favorable, the spending per worker is 20%

- Andorra has a law regulating ICT and online companies with significant tax advantages and 80% exemption from corporate tax

- Andorra has a foreign investment law that favors international investors and companies seeking international capital

- Tax exemptions for dividends from abroad

- indirect tax burden of 4.5% , one of the lowest in Europe

- There is no taxation for residents